What is a toll road worth?

Introduction

Toll roads are a key segment of the global infrastructure market. However, these assets also have some rather unique characteristics. This means that shorthand valuation measures/metrics (eg. P/E ratios and EV/EBITDA) can generate misleading outcomes.

Key characteristics that have an impact on valuing toll roads

The key characteristics to consider when valuing a toll road are outlined below:

- Toll roads operate under a concession agreement (or contract) with a government that, among other things, sets out two critical factors:

- The date at which the concession agreement terminates; and

- The basis on which the tolls will increase.

- When the concession actually terminates, the asset is handed back to the government, i.e. unlike most other enterprises, there is no terminal value.

- Toll roads operate on relatively high EBITDA margins (EBITDA being revenue minus expenses before depreciation, interest and tax), typically around 80%-90% for urban toll roads and 70% for inter-urban roads. This means that for a typical urban toll road, only 10%-20% of revenue is used to operate and maintain the toll road.

- Toll roads involve significant upfront build costs and the standard accounting treatment applied to toll roads is to amortise the capital costs of construction over the life of the concession to reflect expected maintenance or replacement expenditure. However, in the case of a road, maintenance is a relatively small proportion of revenue (say 2% p.a.), and is generally expensed rather than capitalised.

This means that the depreciation entry for accounting purposes significantly overstates the actual expenditure needed to maintain the road. An example of this is Australian toll road company, Transurban, which incurred an accounting depreciation expense of A$550 million but had a cash maintenance cost of only A$55 million.

We believe that P/E ratios are meaningless when analysing toll roads. Not only is the cashflow generated by the business almost always higher than the published accounting earnings, but the ratio also ignores the fundamental nature of toll roads - that they are limited life assets.

- For most normal industrial companies, depreciation is a good proxy for the maintenance costs needed to keep a business operating competitively. However, for toll roads, given the disparity between accounting depreciation and the real cost of maintaining toll roads, accounting earnings can significantly understate the underlying position of the business and the free cash it generates.

- This disparity has another indirect benefit to the underlying value of the business. Accounting earnings are lower and hence so is the tax that the business will have to pay, thus actual post-tax cashflow is higher.

- P/E is a proxy for the net present value of the cashflow from the earnings of a business, however for toll roads, the valuation needs to be based on the underlying free cashflow generation.

.jpg)

The Transurban-owned 495 Express Lanes represents a 22km (13.7 mile) stretch of high occupancy lanes and a key arterial connection in Northern Virginia, USA.

Is an EV to EBITDA multiple a good measure when valuing toll roads?

Another short hand measure often used when valuing normal industrial companies is the Enterprise Value (EV) to EBITDA ratio. In the examples that follow, each case uses a discounted cashflow methodology to value the toll road by forecasting cash flows under the assumptions set out below.1

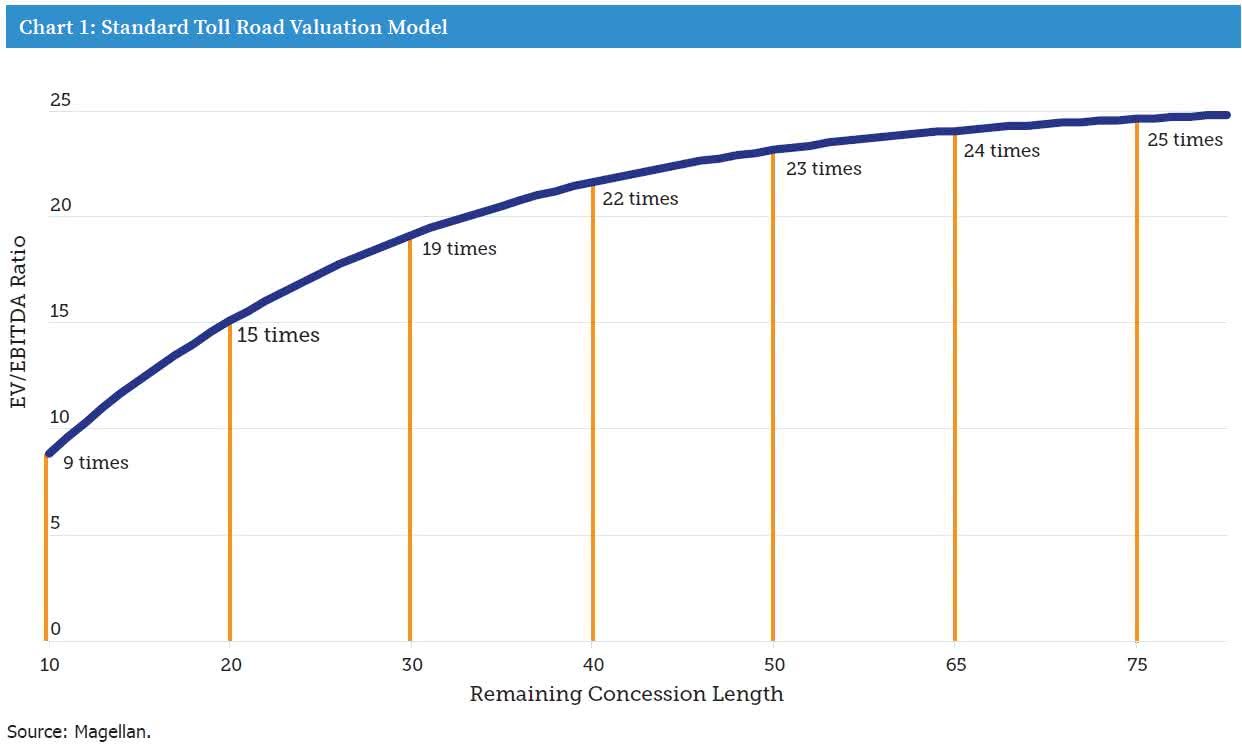

Chart 1 is based on a standard toll road model where the key assumptions are as follows:

- Traffic in Year 1 grows at 2% with the growth rate reducing by 0.1% per annum.

- The EBITDA margin is 75% in year 1, growing each year by 0.5% to a maximum 90%.

- Tolls increase with inflation of 2% p.a.

As Chart 1 highlights, under this scenario the EV/EBITDA ratio appropriate to the valuation of this hypothetical toll road increases with the concession length, so a rational investor would value the toll road at 15 times current year EBITDA if there were only 20 years remaining on the concession but would be prepared to pay 22 times if there were 40 years remaining and almost 25 times if there were 70 years remaining.

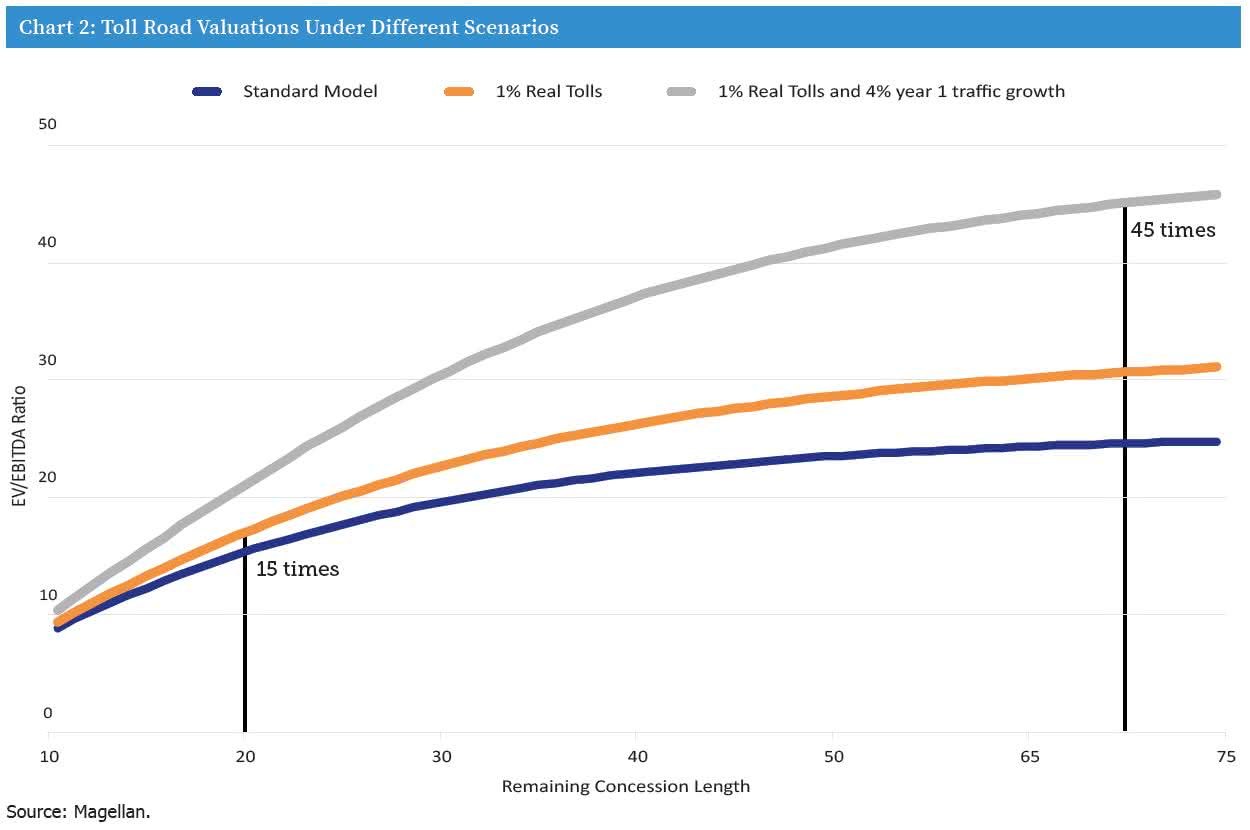

But concession length isn’t the only important variable in valuing a toll road. Given that toll roads have a largely fixed cost base, the rate of growth of revenues can clearly be a critical factor in a toll road’s value. Chart 2 shows the shape of the curve under two additional scenarios:

- Scenario 2: As per the standard model shown in Chart 1 but with tolls increasing by 1% in real terms instead of in line with inflation; and

• Scenario 3: as per Scenario 2 but with traffic growth starting at 4% growth instead of 2% in year 1

(and also fading at 0.1% p.a).

1Valuing the future cash flows of the road using a Weighted Average Cost of Capital of 6.8% based on a nominal cost of equity of 7.0%, a nominal cost of debt of 6.0% and assuming 40% gearing. For simplicity the hypothetical toll road enterprise value is determined pre-tax and interest costs.

As Chart 2 highlights, a rational investor would be prepared to pay approximately 15 times EBITDA for a standard toll road with 20 years remaining in the concession period but as high as 45 times Year 1 EBITDA if it was a scenario 3 toll road with 70 years remaining on the concession.

Every aspect of the toll road’s earnings in the three scenarios in Year 1 is identical, i.e. they all have the same revenue, EBITDA and earnings. Yet the actual NPV of each asset’s future cash flows varies enormously.

Thus EV/EBITDA is also not useful for valuing and comparing toll roads as a fair multiple will be determined by the length of the concession, expected traffic and price growth, none of which are reflected in the current EBITDA of the toll road under analysis.

Concluding comments

Any use of current year financial results such as P/E or EV/EBITDA ratios as a means to determine the value of a toll road is problematic at best and most likely misleading. The corollary is that there is only one way to effectively value a toll road business – value each asset over its entire concession period and aggregate the sum of those assets. On that basis, our analysis suggests that a number of the world’s highest quality toll roads remain attractively priced.

Important Information: This material has been produced by Magellan Asset Management Limited trading as MFG Asset Management ('MFG Asset Management') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an MFG Asset Management financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. MFG Asset Management makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. MFG Asset Management will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MFG Asset Management. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon.

Further information regarding any benchmark referred to herein can be found at www.mfgam.com.au/funds/benchmark-information/. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of MFG Asset Management.